Volatility Running High Across Dow Jones & British Pound Plus Leaderboard Update

More interesting developments overnight, pushing towards a more divided United States than what Americans live right now.

Michael Pompeo, the United States Secretary of State, said in his presser today that there will be a "smooth transition to a second Trump administration."

The debate on Twitter has been incredible, ranging from absolute frustration to confusion.

Following this, President-Elect Joe Biden laughed at the statement and then suggested President Trump's legal battles are an embarrassment.

Following this, President-Elect Joe Biden laughed at the statement and then suggested President Trump's legal battles are an embarrassment.

But to be honest, none of this sideshow moved the markets.

A quick look around the markets shows:

· The Dow Jones up 0.90%

· Nasdaq -1.37%

· S&P500 down 0.14%

· Gold rebounded modestly from Monday's heavy falls

· The British Pound rose 110 pips

· The EURGBP fell 74 pips

· WTI Crude Oil soared to $41.61

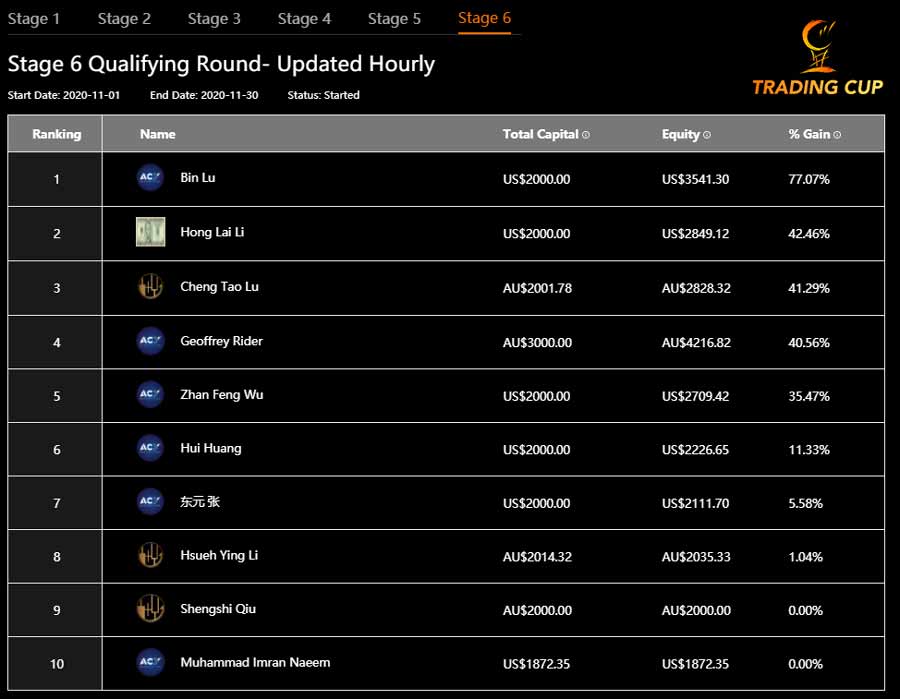

Let's take a look at the current leaderboard.

Bin Lu is up 77%, focusing a lot of his trading activity on the Dow Jones index. Congrats to Bin for such an impressive start to the month.

Hong Lai Li, one of the contest's most consistent performers (10th in Stage 1, 5th in Stage 5, and 4th in Stage 5), is sitting 2nd on 42.46%. Another excellent performance so far in November. We reviewed his October trading statistics here.

And congrats to Cheng Tao Lu, sitting nicely in 3rd place, with 41.29% in returns. Cheng is one of our quiet achieves, placing 8th in Stage 2, 9th in Stage 3, 8th in Stage 4, and now 3rd in Stage 6. There have been some bumps along the road, but overall, a steady, consistent performer.

Dow Jones the popular choice among the leaders

One of the trends this month has been the increased interest in our competitors trading the Dow Jones index.

On Monday, we reviewed the incredible trading statistics of Geoffrey Rider, who had focused all his trading activities on the Dow Jones Index.

And we can confirm that the current leader has placed 65% of his trades are the Dow Jones Index this month.

And when you look at the chart, it has been one-way traffic since the 30th of October, rising in 7 of 8 trading days, with the bulls seemingly in control.

Of course, for those closely following the markets, Monday's big move higher due to the positive vaccine trial news from Pfizer hitting the newswires.

British Pound breaks out of resistance, rising over 100 pips overnight

The British Pound managed to be one of the best performing currency pairs overnight, rising 110 pips and breaking out of the consolidation zone.

The Pound hasn't been this high since the 4th of September. It will be interesting to see if the fundamentals continue to play out, and momentum can push it high enough to test previous highs from the 1st of September.

Let's take a look at the chart below.

According to Reuters, the Sterling pushed higher based on Brexit news and vaccine hopes. With the UK currently at 1,233,775 cases, you can see how strong a vaccine hope is for their nation's future. Couple this with the lockdown fiasco with Boris Johnson and his team and it is easy to see why the Pound is rallying.

According to Reuters, the Sterling pushed higher based on Brexit news and vaccine hopes. With the UK currently at 1,233,775 cases, you can see how strong a vaccine hope is for their nation's future. Couple this with the lockdown fiasco with Boris Johnson and his team and it is easy to see why the Pound is rallying.

But we also heard from Goldman Sachs on Tuesday suggesting they are optimistic about a Brexit deal, and they recommended selling the Euro.

But we also heard from Goldman Sachs on Tuesday suggesting they are optimistic about a Brexit deal, and they recommended selling the Euro.

This also took its toll on the EURGBP, breaking support and heading lower. We've seen the EURGBP drop 380+pips in the last 42 days, as the Euro continues to weaken against the Sterling.

Where will the trading volatility be over the next few days?

Let's take a look around the market to see where the volatility could be over the next few days.

· Gold fell the most on Monday since the significant fall on the 11th of August this year. A massive $95 drop following the positive vaccine trial news from Pfizer. The likelihood of more volatility on this asset class is relatively high, especially given how the recent low on that day tested a previous support level.

· The Aussie dollar has reason several hundred pips over the last few days, and the stochastic indicator shows overbought. Could a pullback be possible from here or a continuation of the bullish trend we've seen so far in November?

· WTI Crude Oil has had two recent explosive moves higher and is now teetering on a resistance level, with even more resistance overhead at the $43.30 level. Time will tell if the bullish momentum can continue or the black gold will test recent lows.

We wish you the best of luck in Stage 6, and may your trading system deliver on your backtested results.

Are you ready to join the next Stage? Click here to register an account.

Ashley Jessen is the author of CFDs Made Simple and Chief Operating Officer at ACY Securities. He has been in the financial services industry since the year 2000 and worked for some of the leading companies in the CFD, Forex and Online Trading space.