Applying Pyramiding Trading Strategy In Controlling Drawdown Results A 185% Returns

There are numerous trading success stories in 2022 to inspire traders of all levels in 2023 and beyond.

In today’s Trading Cup trader spotlight, we unravel Zhong Hua Wang’s trading performance, who generated 185% from July to mid-September 2022, and how he delivered such an incredible feat.

Let’s take a look at the current Trading Cup leaderboard.

You can see the results of the current top 10 competing traders.

Our statistics section also showcases their key trading metrics to give you an insight into their trading strategies.

You can check out the live stats through the Trading Cup homepage.

Watch the Pip Hunter Trading Contest - Top 3 on the Leaderboard - December Update:

Let’s discuss Zhong Hua’s trading statistics.

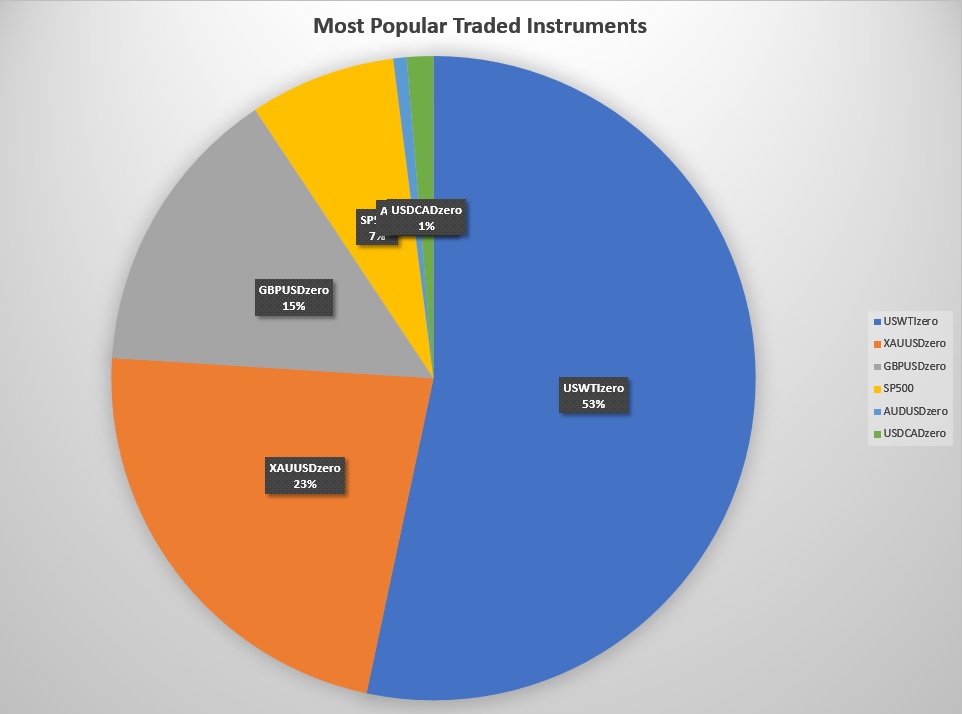

He performed a total of 150 trades across the following six instruments:

- Total Trades: 150

- Loss trades: 70

- Won trades: 80

- Win rate: 53.33%

- Average gain on wins: $103.51

- Average loss on losses: -$63.86

- Biggest Win: $701.80 (USWTI)

- Biggest Loss: -$446.45 (SP500)

- Trade Direction: 8 Buys/Longs & 142 Sells/Shorts (94.67% of all his traders are sells/shorts)

- Best Performing Instrument: USWTI ($3,364.90 PnL)

- Worst Performing Instrument: SP500 (-$768.60 PnL)

- Quickest Trade: 1 minute (USWTI)

- Longest Trade: Approximately 9 days and 1 hour (SP500)

- Average Trading Volume: 0.40 Lot Size

- Smallest Trading Volume: 0.05 Lot Size

-

Largest Trading Volume: 5 Lot Size (SP500)

Overall, Zhong Hua is not an aggressive trader.

He is a classical average joe trader. Has performed 150 trades only in 78 days with a 53.33% win rate percentage. He’s more of a seller (shorting 94.67% of his trades).

His biggest win and best-performing instrument was USWTI. His worst was the SP500 which kept him stuck in a trade for 9 days but also delivered his biggest loss as well as his largest single trading volume.

He had a bad time with the SP500 and allowed his largest trading volume of 5 lot size in hopes of getting at least break even but went for the worst.

He got greedy on the SP500 and over-leveraged, as shown in the 11 trades highlighted below.

Fortunately for him, he managed to control his risks and turn the tables which I explain later.

Always remember trading involves risk, especially when dealing with leverage.

Drawdowns

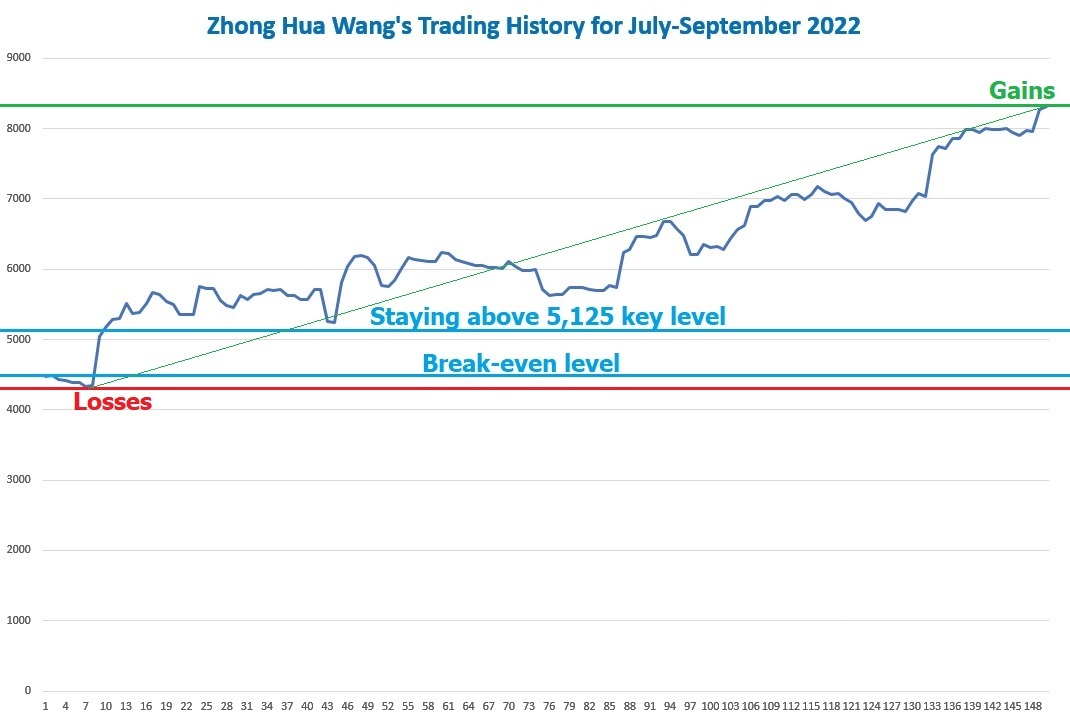

We can tell how the risks are managed by assessing his drawdown, especially the short-term trades.

Risk management is about preserving the capital, securing the gains, and minimising the losses.

Zhong Hua had a bad start with 8 trades resulting in a net loss of -$159.80 before he pulled out an amazing two and a half months of exceptional trading, generating 185% in returns!

I should say he’s much of a pretty solid trader getting an average of 2.47% daily returns in 75 days.

Perhaps his initial drawdown when he started placing trades, resulted in a more focused effort, as his 9th to 44th trades were all held above the $5,125 key level. Nothing like a series of losses to get your attention on subsequent trades.

This key level played a vital role during the remaining trades and became a positive turning point throughout the finish.

His biggest loss was only allowed during the negative start but he eventually closed out the trading period with the most significant gains as well!

He has such impressive drawdown control as if he foresaw his trading outcome during the period.

His average drawdowns from the entire period were kept within the 2-10% range.

Pyramiding Trading

Zhong Hua’s drawdown curve reminds me of the Pyramiding trading strategy and the Rabbit-Turtle race story. It’s more of a steady amassing of gains and holding losses simultaneously.

This strategy can be applied in controlling drawdown, not just the trades themselves, and Zhong Hua set an example for that.

Generally, in a bullish trade pattern, after some minor pull-backs have occurred, there is likely an uptrend continuation once key level of supports are observed.

Although it appears to be a one-direction biased trading, Pyramiding in drawdown control works in the case of Zhong Hua.

More from Zhong Hua:

- Turning a bad start initially into an excellent foundation of focus and excellent trades.

- The ability to keep his drawdown within the 3-10% range.

- Protecting a key gain level.

- Applying a Pyramiding trading strategy in drawdowns as major factor in helping him achieve his outstanding returns.

-

Successfully dealt with leveraged trading, and despite suffering risks, came out on top.

Congratulations to Zhong Hua Wang, who made a great recovery and held his gains to the end!

If you are a trader or a fund manager, showcase your trading skills by joining the Trading Cup 2023 competition now!

Stay tuned to our blog and social accounts for more trader spotlights.

Related articles:

Trading Cup 2022 Trader Spotlight – Staggering Performance of 1500% Gains

Trading Cup 2022 Trader Spotlight – One Trading Instrument That Made Up 93% Of Total Returns

Ken Aguilar's experience spans 11 years in the financial markets, working for many of the largest Forex and CFD companies. Ken's trading style focuses primarily on short term trading the FX Majors & Cryptos, using a combination of Fundamental and Technical Analysis.