Trading Cup 2022 Trader Spotlight – Staggering Performance of 1500% Gains

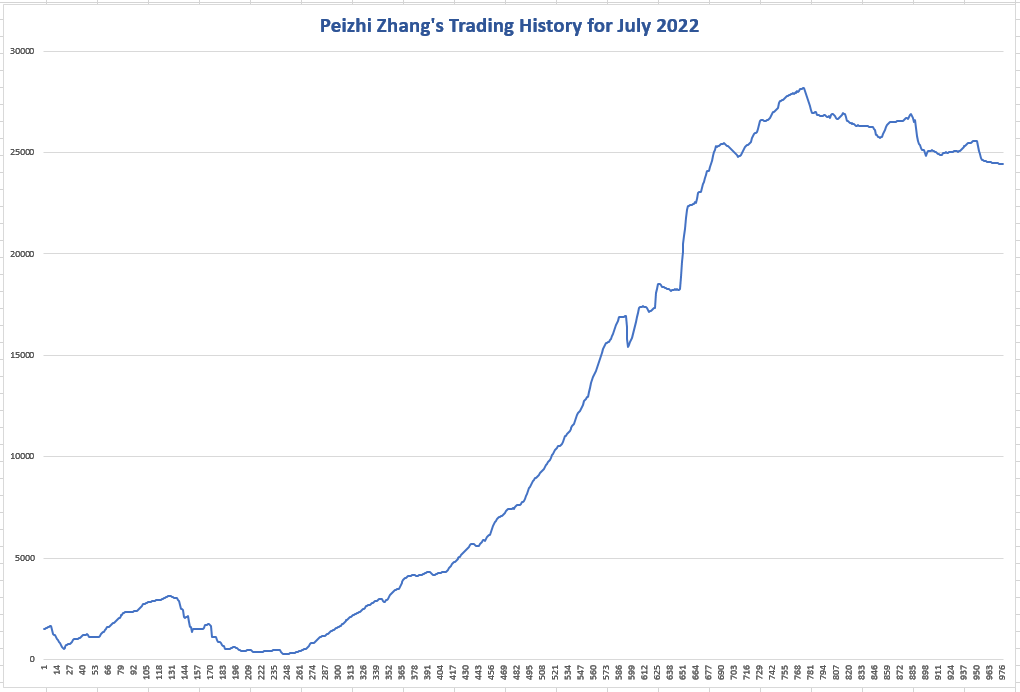

In today’s blog, we highlight Peizhi Zhang’s performance in our ongoing Trading Cup 2022 trading contest who amassed a staggering 1500% gains during the month of July.

We uncover how he achieved these stellar gains, the strategy used, the trading instruments selected and more.

My goal here is to deliver the highlighted trader of the month, his key strengths and weaknesses, and how he handled his drawdowns.

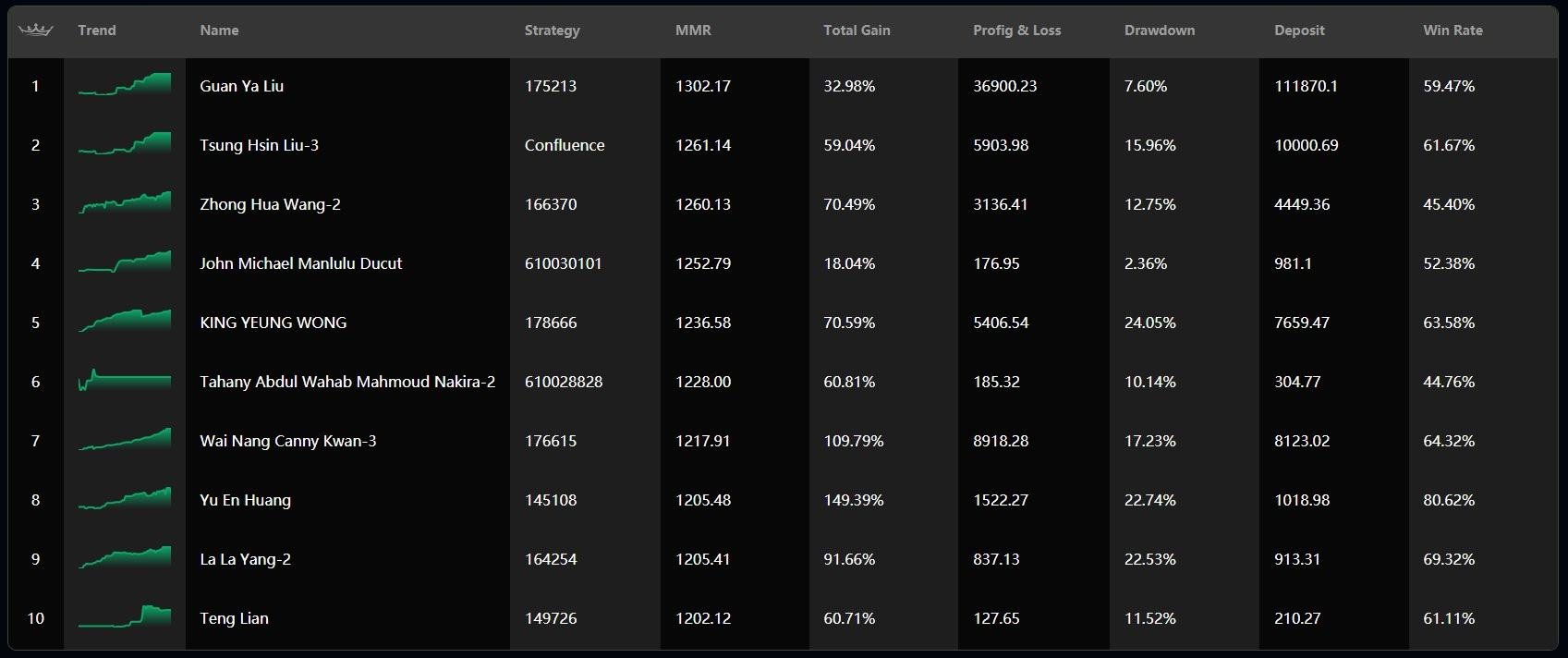

The Trading Cup leaderboard updates regularly so you can see the results of the top 10 competing traders. Our statistics section also showcases their key trading metrics to give you an insight into their trading strategies.

You can check out the live stats through the Trading Cup homepage.

In today’s trader profile, I’ll be reviewing Peizhi Zhang. In particular, we are looking at Peizhi’s ability to turn his starting balance of $1,500 to a whopping $24,000 in the month of June 2022. And yes, he achieved the 1500% return in just one month.

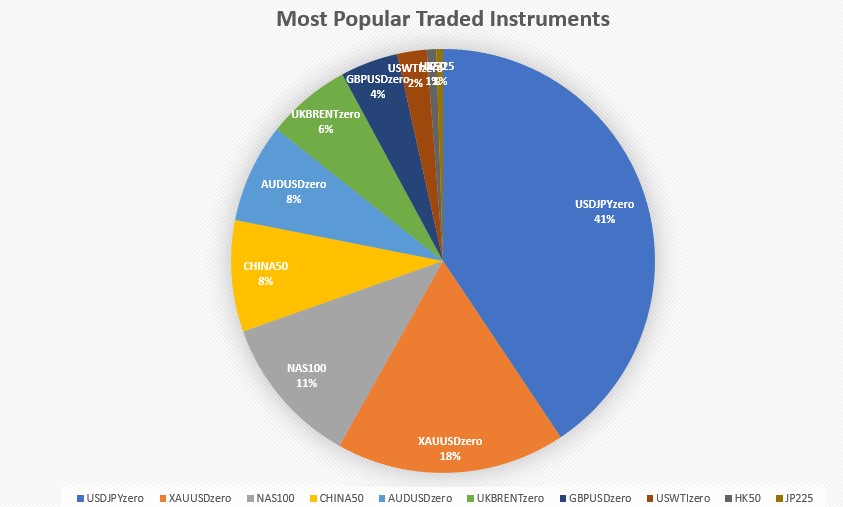

He performed a total of 977 trades across different trading instruments including:

Indeed, an interesting mix of instruments.

Most of his largest wins were focussed heavily on the UKBrent though only 6% of all his trades were placed on this trading instrument yet most of his profits came from there.

In fact, these typical large trades profited an average of $500 per trade comprising 19% of his final PnL (Profit and Losses Equity).

He held his drawdowns very well.

His biggest win was $710 while the biggest loss was $583!

In total, his average gain across all 977 trades was $23.48 including 4 break-even trades and 260 losses.

The fact that he won 713 out of these total trades is mind blowing! Such a high win ratio with an excellent drawdown control. What a trader!

Here is a break-down of his full monthly trading statistics:

- Total Trades: 977

- Break-even trades: 4

- Loss trades: 260

- Won trades: 713

- Win rate: 73%

- Average gain on wins: $54.30

-

Average loss on losses: -$60.67

His average loss on failed trades was slightly higher than his average gains on his wins. This is a clear example of good drawdown control of a highly skilled trader knowing his starting balance is only $1,500.

Famous trading quotes can be seen through his trades ‘keep your losers small while your winners big’. Would you agree?

Some of the questions that sprung to mind when reviewing his statistics were:

- Does he use an algorithmic trading strategy?

-

How much leverage was he using?

To answer these questions, we extract the major trades that delivered the bulk of his success.

You can find out more about algorithmic trading and also leverage.

In his first 100 trades we can see small trading volumes averaging 0.25 per trade only. On a AUDUSD position, this would equate to $25,000 per trade, which is quite large relative to a balance of just $1,500.

From this data, he has mixed results of wins and losses. He must have been testing the markets first before deciding to increase his position size.

Gaining confidence over time, he then increased his trading volume over the next trades until he finished July’s journey with an average of 1.57 lots per trade then reduced it to 0.28 in the last 242 trade executions.

You could suggest that when he had a high conviction on a trade setup, he increased his position size, but knew when to pull back when his trading strategy was less favourable.

His smallest trading volume was 0.01 while the largest was a staggering 15 lots.

On an account of this size, it would be fair to say he is overleveraging, taking on massive risks. But fortunately for him, this led to strong gains during that period.

It is important to understand that trading at this level of leverage is risky and not recommended.

Let’s go back and take a look at some of his prominent trades that show his overall strengths primarily on the UKBrent.

UKBrent hourly chart via ACY MT4

This is his biggest win, gaining a total of $710. I can see he did not place a stop loss or take profit, which indicates he was closely monitoring the trade as it progressed.

Instead, he placed a market trade, hitting the order book after he saw confidence on the immediate resistance and support areas on the hourly chart.

In light of this, you might consider him an experienced trader. This trade is perfectly orchestrated quickly within the hourly candle.

How? This trade duration only lasts for 3 minutes. Astounding!

Meanwhile, below shows his biggest blunder during the period.

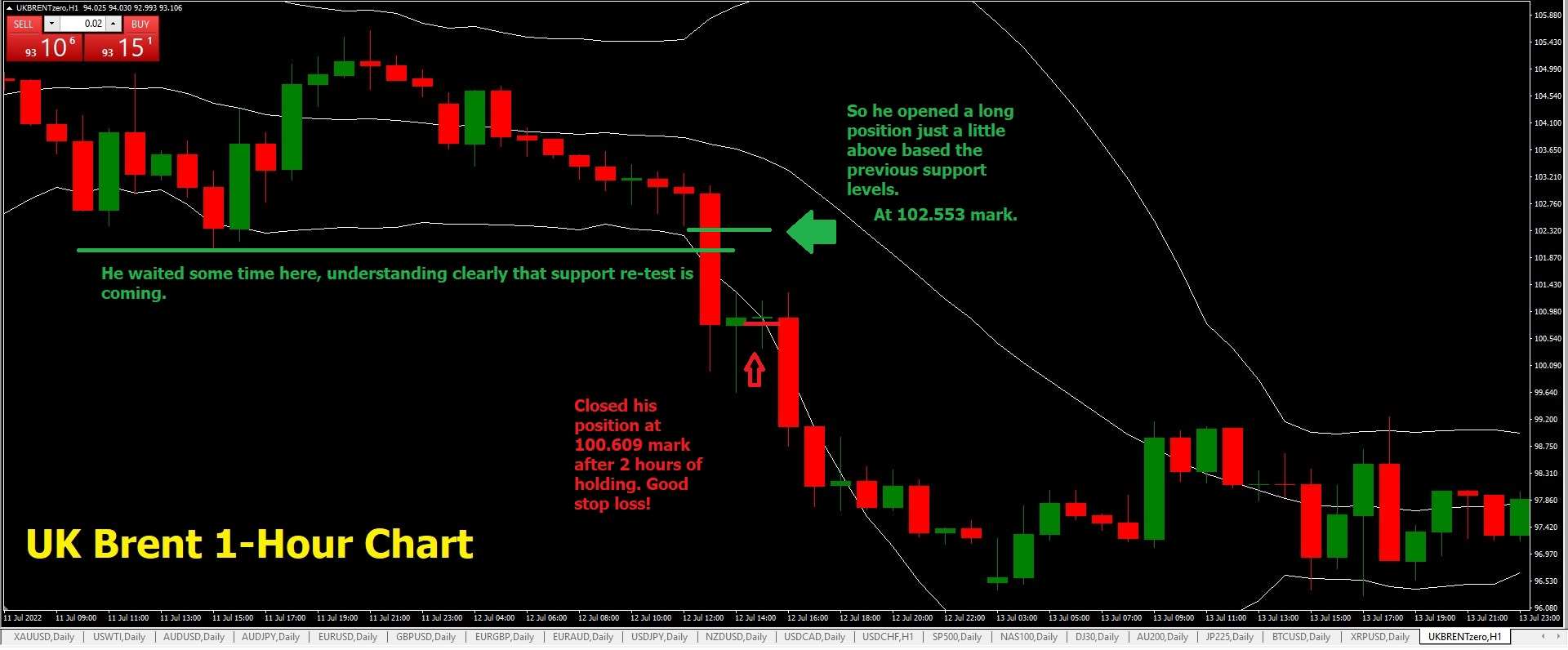

UKBrent hourly chart via ACY MT4

This adds more support of my claim earlier that he is an experienced trader, why?

3 reasons:

- He knows what is coming for the trading instrument, he speculated the nearby support would hold.

- But the trade entered volatility through a support breakdown within the same hour. Totally went in the opposite direction. Then after 2 hours of holding, he decided to trade the price action as a fail of support. Then closed at 100.609 wasting no time. This trade cost him $583.20.

- If you notice, this chart happened first. The lesson we get from here? He managed to win the next trade on the very same instrument getting a net profit of at least $126.80. Turned the tides in his favor. This can be a sort of revenge trading but does not happen all the time. Only experienced traders can do this.

Based from these trades, I assume he made use of leverage and applied the basic skills in locating where the immediate support and resistance levels were.

Again, I say he knows what he’s doing and understands the high risks involved in using leverage. I think he traded manually without using any Expert Advisor (EAs).

Congratulations to Peizhi Zhang who made tremendous gains in the month of July!

If you are a trader or a fund manager, showcase your trading skills by joining the Trading Cup 2022 competition!

Stay tuned in our blog and social accounts for more trader spotlights and always remember that trading involves risk.

Ken Aguilar's experience spans 11 years in the financial markets, working for many of the largest Forex and CFD companies. Ken's trading style focuses primarily on short term trading the FX Majors & Cryptos, using a combination of Fundamental and Technical Analysis.