Trading Spotlight – Geoffrey Rider Shows How to Hit 94% Win Rate on the DJ30

The US Presidential Election has provided plenty of controversies, and more importantly, plenty of volatility in the markets.

Today we will run a trader spotlight with one of our best traders for November, Geoffrey Rider.

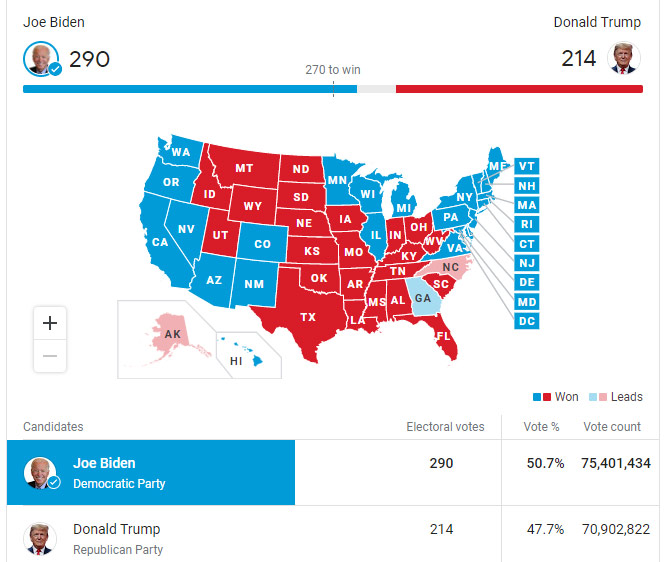

But before we do, let’s take a look at the results as of 2pm AEST on the 9th of November 2020.

As you can see from the chart below, Joe Biden has claimed victory, and the press has confirmed that he will be the new President of the United States. President Trump is believed to be filing legal proceedings against the result, contesting being overthrown for President.

Image courtesy of the Associated Press.

Global Stock markets rally on the back of Joe Biden’s victory

Let’s take a quick look around the markets as they opened on Monday, to see the reaction of Trump’s presidential campaign coming to an end.

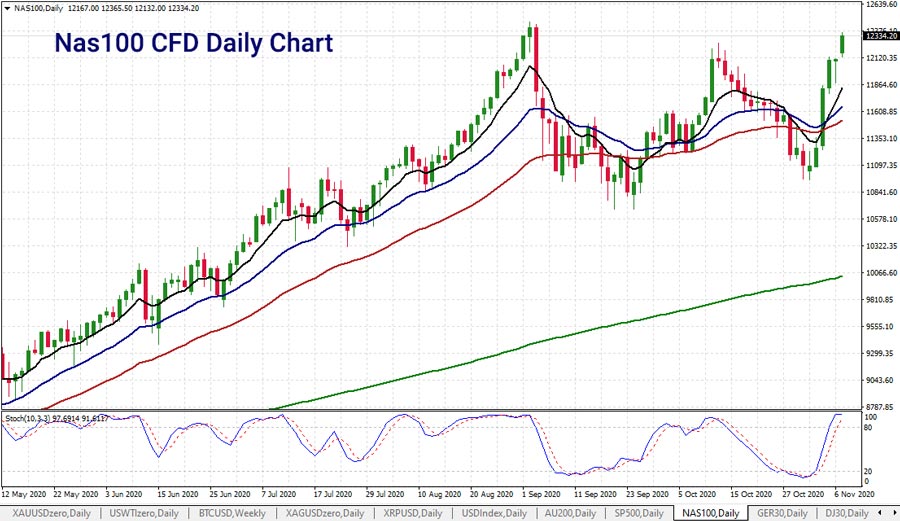

Nasdaq Index

The Nasdaq 100 index has been in a wide range since the recent highs on the 2nd of September this year.

The Election results had seen the index surge 12.5% since the low on the 2nd of November 7 days ago.

As Holger points out below, Big Tech has been boosted, and their combined market cap continues to climb.

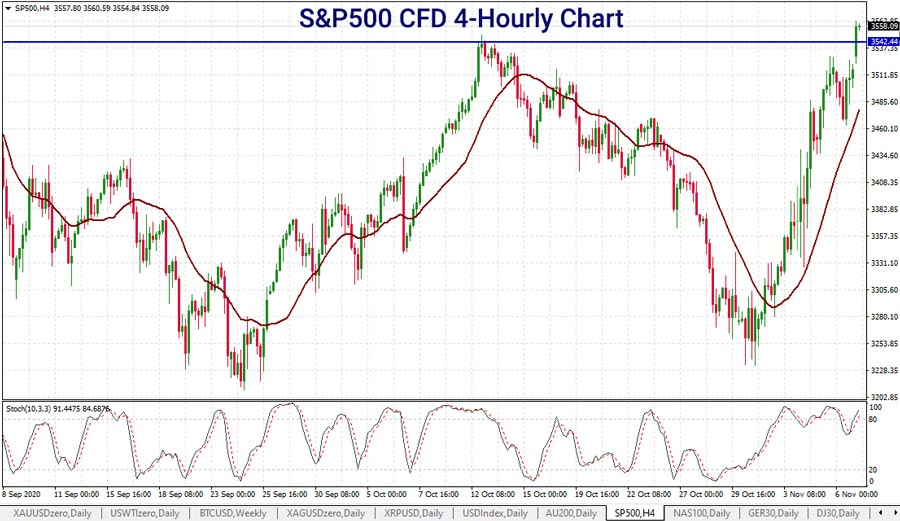

S&P500 Index breaks recent high from the 12th of October

The S&P500 index CFD has also been rising, pushing higher on Monday due to Biden claiming victory.

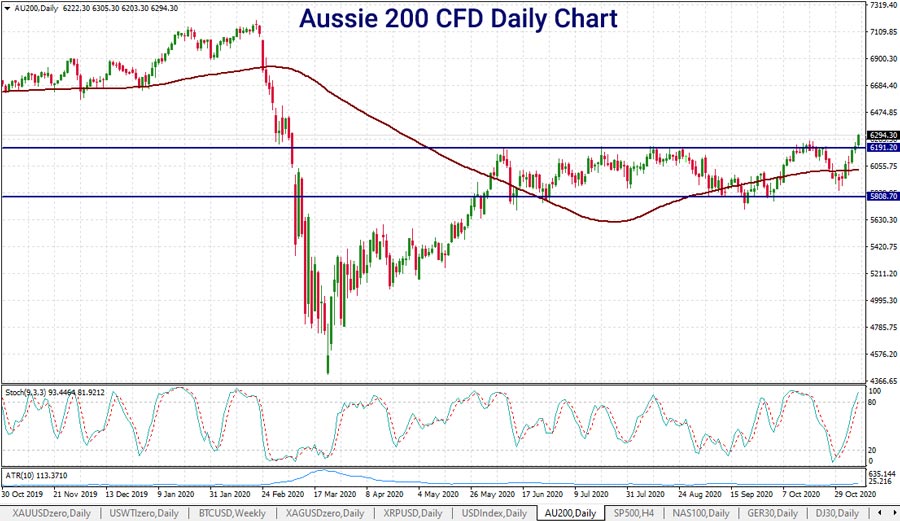

The Aussie 200 index his new short-term high

And a little closer to home, we note that the Aussie 200 index has also broken out of a longer-term range, hitting a new 174-day trading high from back on March 6th.

Trader Spotlight with Geoffrey Rider – Preferred trading instrument

One hundred percent of all Geoffrey’s trades are on the Dow Jones 30 index CFD.

We’ve got several traders who have been in the winning circle this year who have focused exclusively on one product. But most have been trading Gold.

This is the first leader we’ve had who only trades the Dow Jones index.

Not only that, but he has a massive bias towards the long side, with 95.7% of his trades being a buy. Only 4.3% of his trades are to short sell the index.

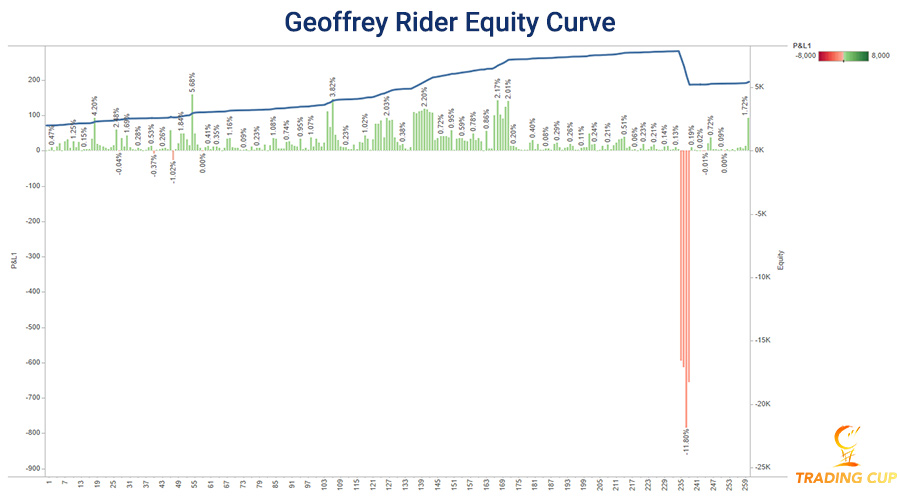

Equity curve, drawdown and percentage win and loss

Geoffrey Rider is one of our most accurate traders this year, as you will note by his equity curve below with plenty of green lines.

The incredible accuracy of his winning trades almost defies comprehension.

But we can see some issues towards the end, as he bought several DJ30 contracts, only to see his most significant losses.

This saw his equity plummet $2,650.04 or 33.6%.

It is never easy recovering from a large drawdown, but his next 22 trades resulted in gains of $227.60. At least a portion of the funds are being recovered through skillful trading.

The question to ask is whether the Dow Jones index will continue to soar, perhaps even breaking above resistance set back on the 3rd of September. Only time will tell, and unfortunately, we don’t have a crystal ball.

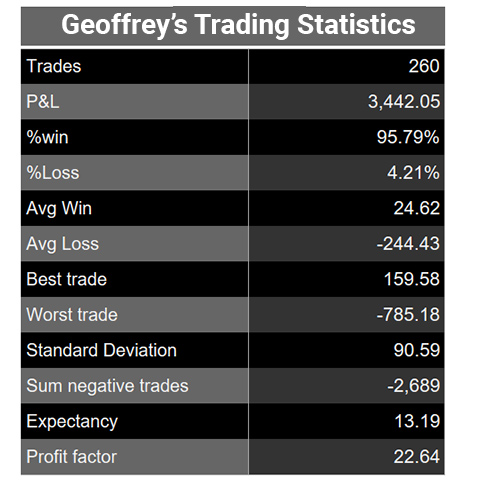

Trading statistics of Geoffrey’s system since his first trade on 3rd November

Geoff funded his account until the 3rd of November and started trading shortly after that. Taking that into account, let’s take a look at his trading statistics in the first 5 days of trading.

As mentioned, Geoffrey has a remarkably accurate win rate, sitting at 95.79%.

But we aren’t talking about a few trades. This win rate is across 260 completed trades.

A truly remarkable feat.

Where the statistics get a little out of control, if that can be said, given his incredible return in 9 days, is the size of his average loss compared to his average win.

At -$244 for an average loss compared to $24.62 for his average win, you can see how this would get out of control if his win percentage were to drop.

Also, his worst trade is 4.9 times greater than his best trade.

This highlights that he can let his losses run but not his wins.

But all of this needs to be in the context of his overall result. Geoffrey is up 182% in 9 days with a 95% strike rate. Those types of statistics are unheard of in anyone’s book.

So while I might run through some of the pros and cons of his system, keep in mind that overall, these are incredibly enviable trading statistics.

The bottom line question you need to ask is this, ‘Would you be willing to suffer a drawdown of 33% in order to gain 180%?’ which is what Geoffrey has accomplished in November.

We look forward to providing you with more trading statistics of system notes of the best traders in the 2020 Trading Cup.

Are you ready to join the next Stage? Click here to register an account.

Ashley Jessen is the author of CFDs Made Simple and Chief Operating Officer at ACY Securities. He has been in the financial services industry since the year 2000 and worked for some of the leading companies in the CFD, Forex and Online Trading space.