Gold Silver Ratio & Ray Dalio & Warren Buffett Buying Gold

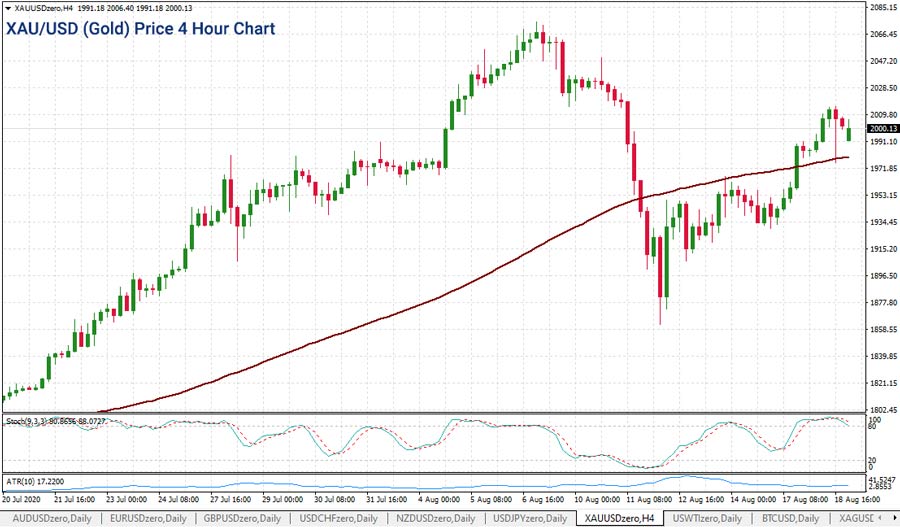

August has seen some ups and downs in terms of trading results, due to Gold rallying to new highs and then pulling back strongly.

This saw our two leaders, who were long Gold and making several hundred percent, give all those gains back.

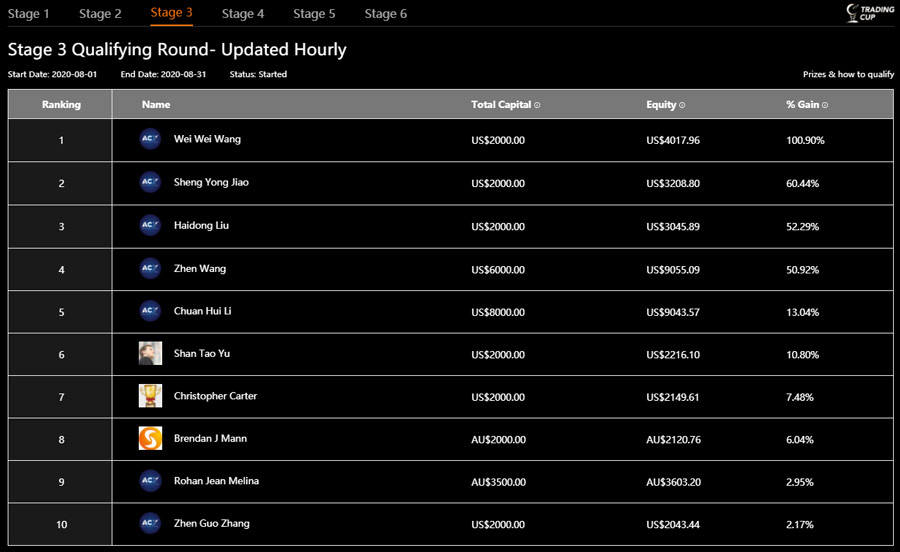

But they did not lose faith in the precious metal, as is evident by Zhen Wang back in 4th position, with gains of 50.92%. Please note, trading in leveraged products is risky, and you can lose more than your starting capital.

You can see the current Trading Cup leaderboard below.

Wei Wei Wang moves to the front trading a wide number of instruments

As you can see, Wei Wei Wang is leading, with gains of 100.90%.

What is interesting to note is how active she is across all trading instruments.

A quick look across her trading history shows a total of 17 different instruments, including the Gold, all the Forex majors (EURUSD, GBPUSD, USDCHF, USDCAD, AUDUSD etc.), WTI Crude Oil, and a few crosses like GBPJPY, CADJPY, AUDJPY and EURGBP to name a few.

Here are a few statistics from his closed trades in August:

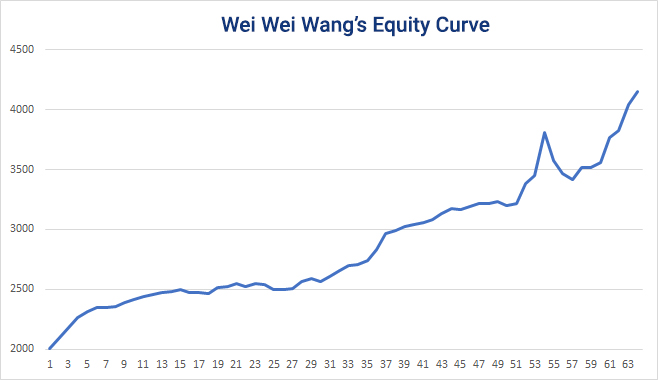

· 64 closed trades

· 79.7% winning trades

· 20.3% losing trades

· Largest win $363

· Largest loss -$241

· Average win $53

· Average loss -$43

You can see from her equity curve below how consistent she is with her trading. Her last five closed trades resulted in gains of $635, pushing her account to new highs and above the 100% in gains for the month.

Congratulations Wei Wei, on such a consistent performance.

Gold and Silver ratios down from over 122

The pullback in Gold and Silver this month, really threw the cat among the pigeons, causing our leaders to erase all their gains, but also provide a new chance to enter long positions from lower levels.

What is interesting to note is the Gold/Silver ratio, which just the other week hit an all-time high of 122.

Since the peak in Gold on the 7th of August, the Gold/Silver ratio is now around 72.

The historical Gold/Silver ratio average is around the 50-55 level.

You can find out more about all the recent pullbacks in Gold and Silver plus the Gold/Silver ratio by watching the GoldSilver.com video interview below.

As they note, all recent corrections in both Gold and Silver are well in line with previous pullbacks on historical run-ups.

Ray Dalio increases his position in Gold ETF along with Warren Buffett

As noted by a Reuters article last week, Billionaire investor Ray Dalio of Bridgewater Associates, bought the equivalent of 170,000 ounces of Gold worth $340 million.

Not only that but Billionaire investor Warren Buffett of Berkshire Hathaway, initiated a $562 million position in miner Barrick Gold in the second quarter, according to an article on CNBC.

Ray Dalio recently doubled his position from $500 million to $1 billion. Plus Warren Buffett has started to accumulate as well.

Gold price rallies from the recent lows

As noted in the 4-hour chart of Gold above, the pullback watched the price of Gold drop a massive $212.54 or 10.24%.

Since that low point on the 12th of August, Gold has rallied a handy 7.2% and is now hovering around the round figure of $2,000.

The British Pound has broken out of resistance

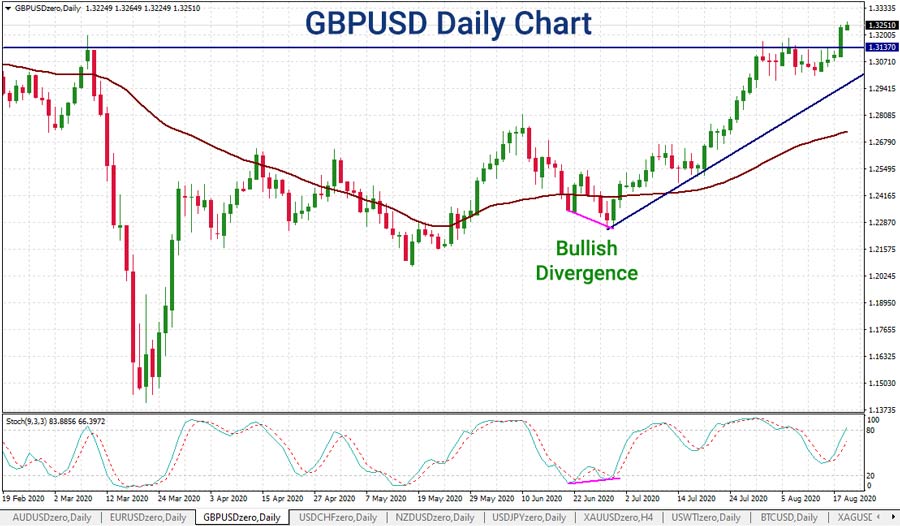

The British Pound continues to benefit from a weaker US dollar, pushing above a recent resistance level, hitting the highest price since the 31st of December 2019 (New Year’s Eve).

Breakout traders have been monitoring the Pound since the bullish divergence noted back on the 30th of June.

Since that point, the GBP/USD pair has risen a massive 851 pips.

As noted here, the US dollar has continued to weaken due to downside pressure forming as Treasury yields had begun to fall over again.

This, coupled with the much worse than expected New York Fed manufacturing data for August, has seen the likes of the British Pound and Eurodollar soar.

How is your trading going?

There is no doubt the recent moves across the major FX pairs plus Gold and Silver have been incredible.

Have you managed to lock in some of those gains on your MT4 trading account?

The key to trading isn’t about making 100% winning trades, which is not possible, but instead, to allocate a small amount of risk across your trading ideas.

Were you thinking recently, with all the economic and geopolitical uncertainty, that Gold and Silver could rise but never took a position?

Then you are not alone.

But you can fix that by opening a trading account and entering our 2020 Trading Cup and seeing if your views across FX, Indices and Precious Metals is correct.

If you are right on your trading ideas, then your account will likely move forward.

If you are wrong, then if you have applied sensible risk management rules, you stand to lose a small amount of your account.

The key idea here is to never risk more than 1-2% of your account on any one trade at any one time.

And remember, trading leveraged products is risky, and you can lose more than you start with.

Are you ready to join the next Stage? Click here to register an account.

Ashley Jessen is the author of CFDs Made Simple and Chief Operating Officer at ACY Securities. He has been in the financial services industry since the year 2000 and worked for some of the leading companies in the CFD, Forex and Online Trading space.