British Pound Rockets Higher Due to Brexit Optimism, Bitcoin Above $13,000

Last night saw some huge moves across several markets, including over 200 pips on the GBPUSD, $1,000 on Bitcoin, the Aussie dollar rocketed higher, and WTI Crude Oil was down heavily.

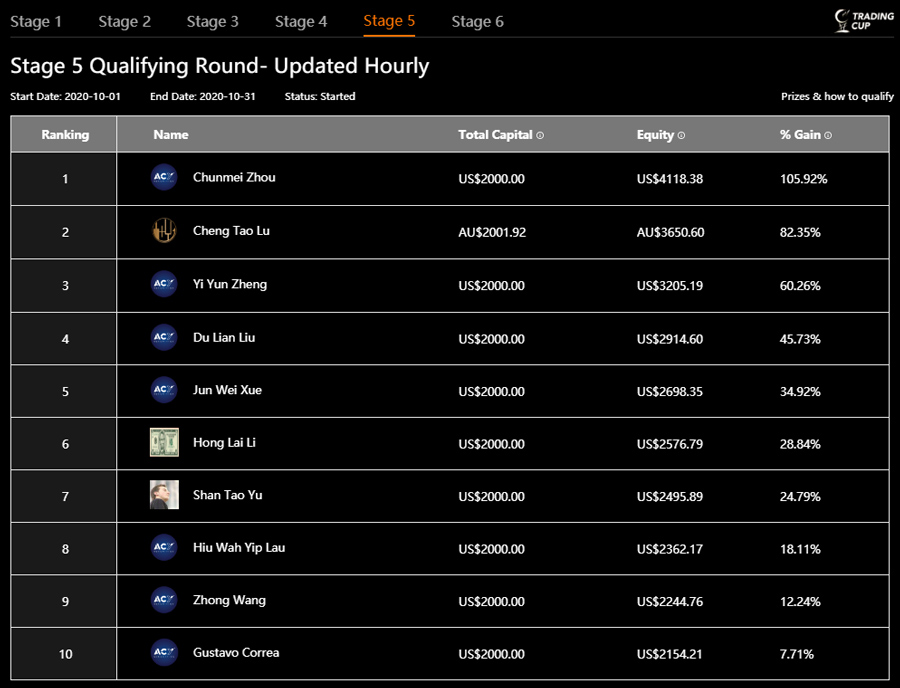

So it was interesting to see how the leaderboard would respond to these huge moves and who was able to capitalise on them.

As it turns out, the leaderboard appears to be trading reasonably conservatively, with no one dominating. Nor have they taken advantage of any of the big moves to catapult to the top of the list.

Instead, we have seen relatively steady trading and position sizing rules, which has seen a tight collection of traders in the top ten.

Chunmei Zhou has a commanding lead, sitting at 105% over 2nd place Cheng Tao Lu, an excellent month, up 82%. We reviewed Cheng’s trading stats here previously.

Chunmei has only made 60 trades in October but has won on 57 of them or 95%. Her main interest is in trading Gold, with a few trades on WTI Crude Oil, EURUSD, DJ30, and GBPJPY.

A huge congratulations to Chunmei. We look forward to seeing how the final week of trading plays out.

Let’s take a look at the leaderboard.

While most of the Trading Cup traders love the low spreads on the precious metal, many have also been trading a few of the most volatile pairs.

Today we’ll take a look at both the British Pound and Bitcoin.

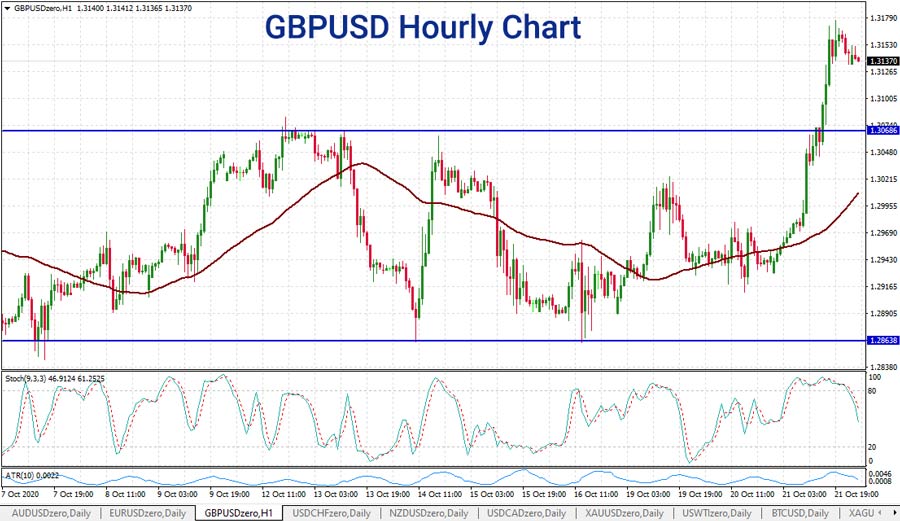

British Pound rockets higher, taking our short term highs

There has been plenty of uncertainty around the British Pound over the last month and a half, with the Sterling hitting the highest price in nearly a year back on the 1st of September.

Since that minor breakout, the Pound has been one of the more volatile Forex pairs, falling 6.11% in 16 trading days, then consolidating as uncertainty around Brexit talks continued.

Overnight, Bloomberg reports that the ‘The pound climbed the most since March’s market turmoil on bets that a Brexit deal might still be possible next month.’

Could we see a deal come through on the resumption of trade negotiations? Is the European Union willing to compromise?

Morgan Stanley has suggested going long the GBPUSD pair, citing a ‘70% probability of a Brexit deal.’

This does provide an interesting scenario for Trading Cup traders as we head into the final eight days of October.

Who will be able to take advantage of the volatility on the Pound?

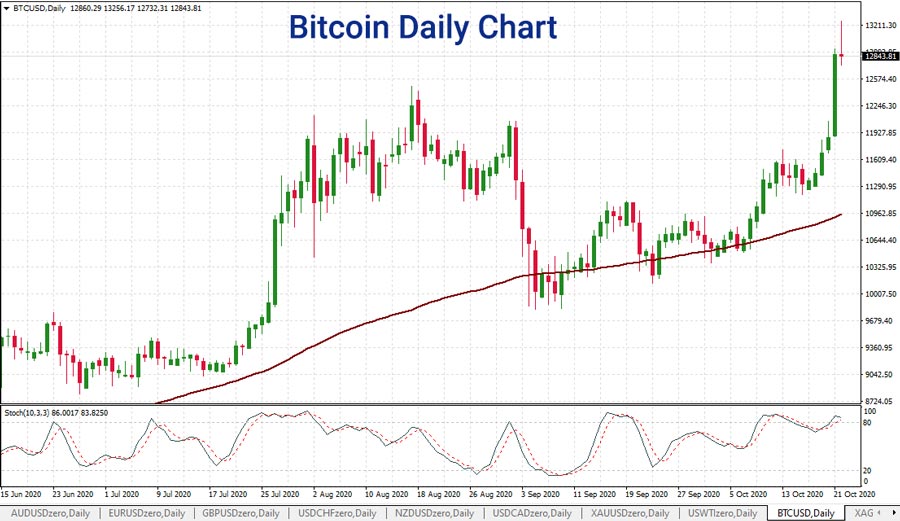

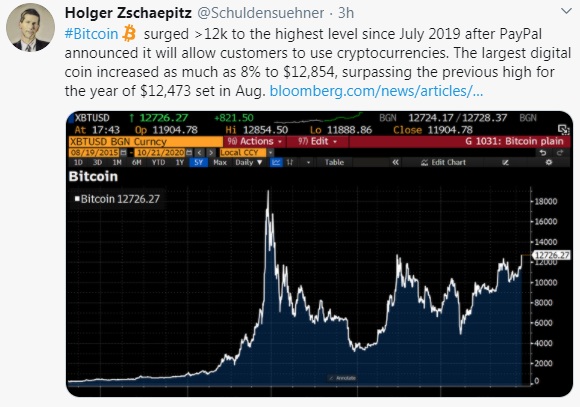

Bitcoin hits the highest price in 470 days

Bitcoin has been one of the fastest moving assets in October, rising 16.7% in just 20 days.

During this time, I’ve seen the likes of Robert Kiyosaki, Alex Saunders from Nugget’s News, and even the legendary Raoul Pal from Real Vision suggest that cryptos could be in for a stellar rise in 2020.

And the interesting thing is, they haven’t been wrong. BTC/USD has had bullish momentum on its side. Since the intraday lows on the 9th of September, the largest cap crypto has risen 26.54% in just 30 trading days.

The consecutive run of higher lows and higher highs is something every technical analyst will be paying close attention to.

As for the recent push higher, it comes off the back of PayPal announcing it will allow customers to use cryptocurrencies.

With only nine days left until the end of the month, it is still anyone’s game.

We’ve seen in many previous months how a few traders entered in the last week and managed to place in the top 5.

Perhaps there are many benefits to entering a trading contest in the last week of trading. If you have your daily trading habits in place and they allow you to peak right at the end of the contest, then all the better for you.

Are you ready to enter into the last week of Stage 5?

You now only have two chances left to compete and receive an invite to the Grand Final. Click here to view the 2020 Trading Cup Qualifiers.

Are you ready to join the next Stage? Click here to register an account.

Ashley Jessen is the author of CFDs Made Simple and Chief Operating Officer at ACY Securities. He has been in the financial services industry since the year 2000 and worked for some of the leading companies in the CFD, Forex and Online Trading space.