Interview with Dulian Liu – 2nd Place in Stage 5 with 143% Return

Interviewing the best traders in the 2020 Trading Cup are our most popular posts with our audience and for excellent reason.

Every trader is looking for a key distinction, that point of differentiation, and anything that can help develop a strong and more consistent trading edge.

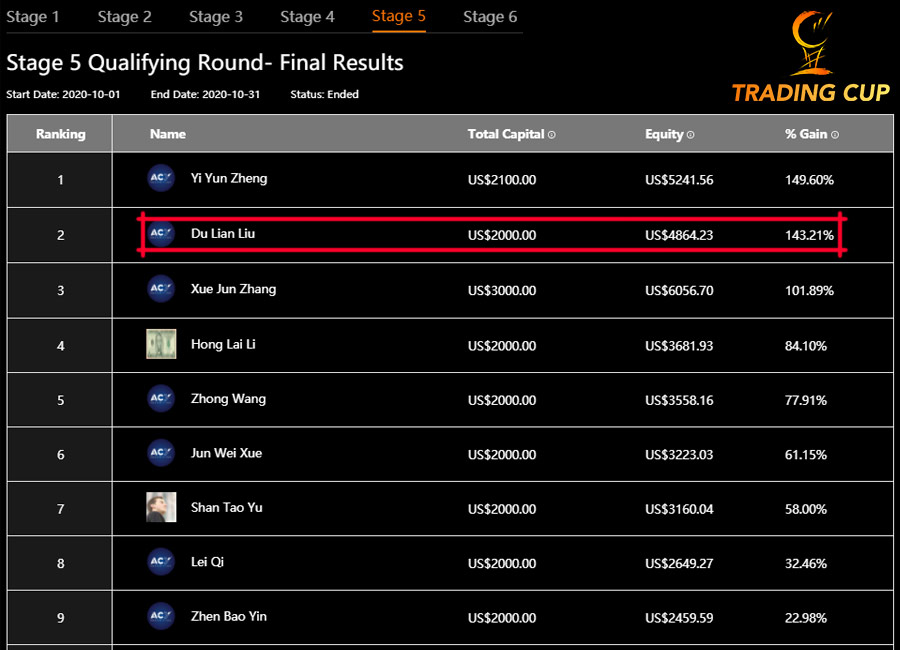

Our October leaderboard saw Du Lian Liu place 2nd, with a gain of 143%, following his 3rd place result in Stage 4.

Could we see a trend with Dulian’s trading? Is he destined to place 1st in Stage 6? We certainly hope so.

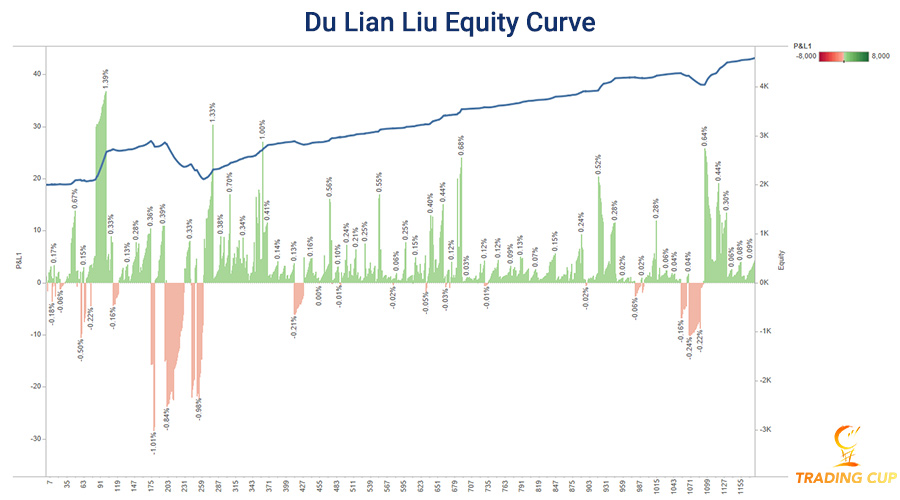

Before we get to his interview, let’s recap his trading statistics, equity curve, and drawdown levels from October.

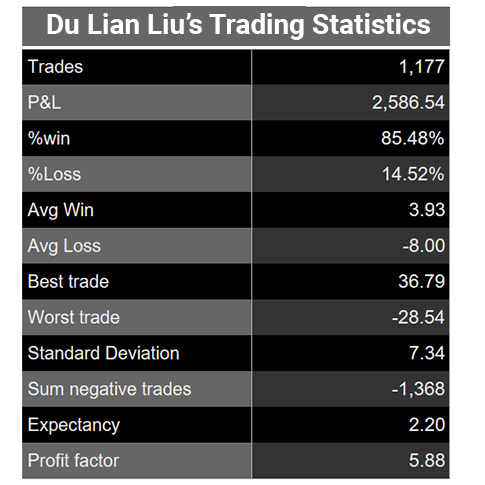

Trading statistics for Mr Liu’s outstanding Stage 5 results

There is no doubt Dulian is an extremely active trader. On average, he is placing around 37 trades per day.

You will notice lots of green bars below due to his win rate of 85%.

But you will also notice a large drawdown towards the start, which also caught our 3rd placegetter, Xue Jun Zhang, by surprise. We showcase his trading stats and 23% drawdown level here.

For Dulian, this happened on Gold, and across 88 trades and an equity peak at $2896.64, he then plummeted to an equity low of 2115.53.

This resulted in a maximum drawdown of 26.9%.

But his recovery was swift and strong, making 151 consecutive winning trades.

His exact trading statistics for the month are below.

Below is a snapshot of Du Lian Liu’s incredible Stage 5 trading results in relation to the top ten placegetters.

Please note that trading leveraged instruments is risky, and you can lose more than what you start with.

Interview with 2nd placegetting Dulian Liu and Renee Li

Let’s now catch up with Dulian and Renee Li, to hear about his incredible month and what helped him achieve his results.

Renee: Congratulation for placing the third at stage 4, and the second at stage 5, Mr. Du Lian Liu. What contributed to your ultimate success, having a place at 2 stages of the competition?

Dulian Liu: Sure, I would love to. I think we need to take a look at both fundamental and technical analysis when it comes to trading. For fundamental analysis, we need to keep a close eye on the economic events. Take today’s US election day as an example. I am expecting the gold price to drop first then going up before dropping again. Personally, I think what happened in 2016 might happen again in 2020 US Election. I studied what happened to the gold price back to 2016 around election time and reached that conclusion.

Renee: Interesting!

Dulian Liu: Therefore, a trading day like the US election day, it is hard to just predict the pricing movements purely based on technical analysis.

Renee: So, can I conclude that your main trading strategy during stage 5 trading competition was to take into account both fundamental and technical analysis?

Dulian Liu: Yes, that was what I did.

Renee: Apart from this, is there any other factors that contribute to your ultimate success? For example, did confidence play a big part?

Dulian Liu: Yeah, apart from applying both fundamental and technical analysis, the way how we implement when we trade is very important as well. For example, how we place an order and how we close an order is also very important. Take myself as an example, I mainly placed 0.01 lots during the trading competition, because I believe that it is the way to help me maximize the profit. To elaborate on this, I will give you an example how I place an order. If I am planning to place a 0.5 lot of Gold, I would break the 0.5 lot to 5 times 0.01 lot. The reason behind this is that when many traders predict the next price movement, what they often do is that they like to specify their prediction to a price point. Theoretically, it might work. However, it is not often the case. In fact, I think narrowing down to a price point is wrong and the right way to do it is to only narrow it down to a range. Because it is nearly impossible to say that at which exact point, the price will turn, while expecting the price to turn when it reaches a certain range is something more realistic and feasible.

Renee: You talked about the success factors. Now can we move on to the differences? Compared to stage 4, did you do anything different in stage 5, in terms of trading strategies or position sizing?

Dulian Liu: hmmm… basically, my trading strategies have been pretty consistent through out this competition so far.

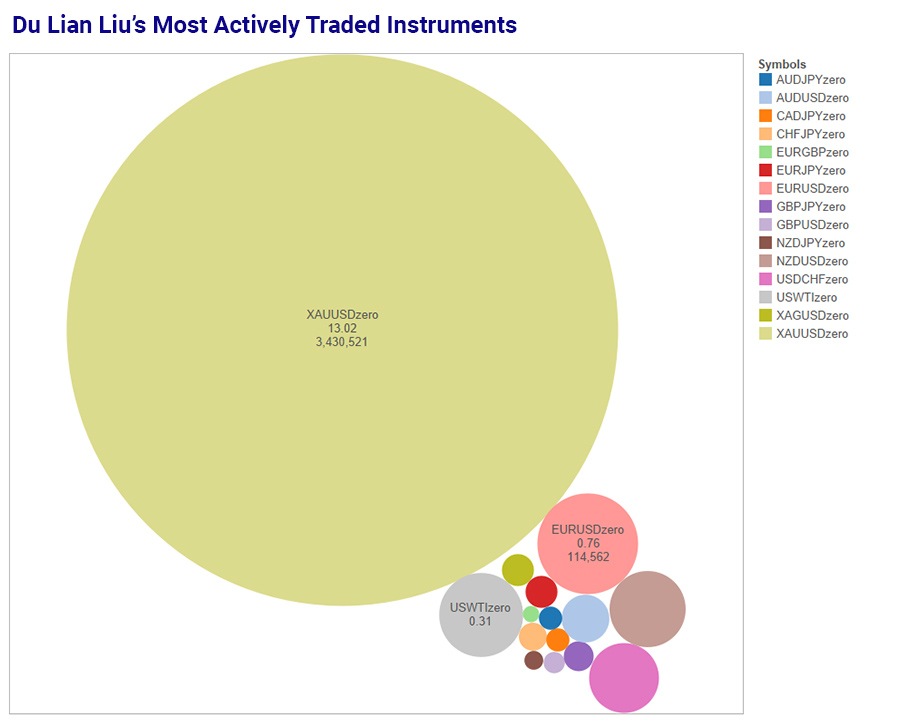

Renee: What about trading instruments? What are the main trading instruments you traded at stage 5 trading competition?

Dulian Liu: I mainly traded Gold. I also traded some forex, but I would only trade forex when I am positive about the price next movements. I would not just get into the forex market and place orders without doing my homework.

Renee: Congratulation to you for earning the ticket to our grand final night trading competition! Have you thought about the final night? Have you thought about what trading strategies you are going to apply in the final competition?

Dulian Liu: I have thought about it. To be honest, I am confident to apply my current trading strategies into the grand final night trading competition, because I do not think it is suitable due to time limitations. As I mentioned before, the core of my trading strategies are to place many 0.01 lots individually and these many 0.01 positions helped me generate the sum amount of profit. But this strategy might not work at a competition like the grand final night as we only get 1 hour.

Renee: So would you consider to adjust your trading strategies based on the rules for our grand final trading competition?

Dulian Liu: Yes, I will think about how to adjust my trading strategies.

Renee: Thank you for having the interview with us, Mr Liu! We are looking forward to your great performance in the grand final night!

Dulian Liu: Thank you for having me. And a big thank you to ACY Securities for providing such amazing platform and opportunity for us traders!

Other Interviews with the winners in 2020

Click the links below to catch up with interviews from our past champions.

· Interview with Stage 4 Champion James Hu

· Interview with Yuan Tsui – 2nd Place Stage 2

· Interview with Stage 2 Champion Zhen Wang

· Interview with Wen Bin Yang - Stage 1 3rd Place

· Stage 1 Interview with the Champion Mao Long Yang

· Algo Trading His Way to the Grand Final – Interview with Gustavo Correa

· Interview with One of South Africa’s Best Traders

· Interview with Mr Jilin Xu in the 2020 Trading Cup

Are you ready to join the next Stage? Click here to register an account.

Ashley Jessen is the author of CFDs Made Simple and Chief Operating Officer at ACY Securities. He has been in the financial services industry since the year 2000 and worked for some of the leading companies in the CFD, Forex and Online Trading space.